X

This article written by Jill Jaracz, journalist and contributing writer for Stacker Media, shares 10 things to look for when buying a house, which you may find of interest. Sponsored by TD.

10 things people who work in real estate look for when buying a house

Written by Jill Jaracz, journalist and contributing writer for Stacker Media.

Photo source: jessica.kirsh // Shutterstock

In the U.S., Zillow reported that a little over 5 million existing homes changed hands in 2022. And in Canada, nearly 2 million homes were sold in 2022, according to the Canadian Real Estate Association. That's lower than the record set in 2021 in Canada but is still the second-highest ever.

For homebuyers considering entering the market, read this curated list of some things to look for when buying a house based on research and reports from real estate associations and professionals.

From judging square footage and comparables to property taxes and potential natural disasters, these tips from those who work in real estate can help to navigate the often-turbulent waters of the home-buying process.

Whether you're a first-time homebuyer or looking to add another property to your investment portfolio, keep reading for buying hacks from real estate agents.

Square footage

Photo source: Canva

One of the first things real estate agents look for in a property is square footage.

It determines the amount of livable space. Neither the US, as reported by Washington Post in 2018, nor Canada, according to the Appraisal Institute in Canada in 2013, have a national standard for measuring square footage. Generally, it includes above-ground space that can be heated and accessed year-round, meaning a three-season porch or garage may not be factored in.

Knowing the size can also help you determine the price per square foot, which is important to help understand comparable sales. And it's one of the factors property tax assessors examine when determining property taxes.

What nearby homes sold for recently

Photo source: Canva

All real estate is local, and that's true for home prices as well. Agents look at comparable prices, or "comps," to understand what houses sell for in a given neighborhood. This helps you know whether the home you're looking at in that neighbourhood is priced reasonably.

When looking at comparables, make sure the houses you're comparing are similar in terms of the square footage of both the livable space and lot size, the number of bedrooms and bathrooms, and the age of the house. Although no two houses are exactly alike in features, agents try to get the best examples of comparables and adjust to understand the local market better.

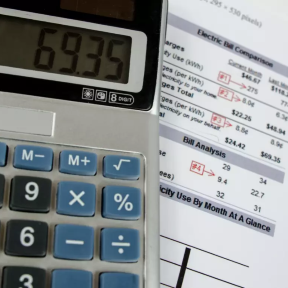

Utility costs

Photo source: Canva

Buying a house is just one part of the homeownership equation. You'll also have to pay for all your utilities, so estimating those costs is important to help determine if you can truly afford the home you want to buy.

Utility costs include such things as heat, electricity, water, and trash/recycling pickup. According to the Government of Canada, in 2022, 63.6% of energy usage goes to space heating in the average Canadian home.

Construction quality

Photo source: Canva

The real estate market in North America has most recently been competitive and many buyers have waived the right to a home inspection, as the National Association of Realtors® reported in August 2022. However, a home inspection is an integral part of the home-buying process and can help you better understand the quality of the house. help you better understand the quality of the house.

Home inspectors look for major issues, such as supporting beam strength, the quality of the pipes, and the status of the insulation. They will also look for what’s structurally and functionally in good shape, so that you can gauge when things may need to be replaced down the road. Perhaps most importantly, an inspector can show you some important elements of the house—like where to turn off the water supply.

In parts of Canada and the U.S., sellers may be legally required to disclose certain information about major problems with the house, such as mold.

The legal structure of the neighborhood

Photo source: Canva

In both the U.S. and Canada, purchasing a condominium often means becoming part of a condo community with other homeowners. In Canada, condo owners typically pay recurring condo fees for the upkeep and insurance for the property, according to the Canada Mortgage and Housing Corporation 2018 buying guide. The group also notes that there is a governing structure that determines rules about living in the community, including bylaws for altering your home’s appearance, using amenities, and limiting the number of occupants.

In the U.S., this governance board is called a homeowner’s association, or HOA, which are run by fellow homeowners who set and enforce policies. In addition to condos, HOAs can also be organized for other types of units like townhouses and a detached home. According to the Foundation for Community Association Research, one in 4 Americans owned a home that's part of a HOA as of 2018.

Local zoning laws

Photo source: Matchou // Shutterstock

Suppose you're buying a house and intend to do major renovations or additions. In that case, you should know the community's zoning laws ahead of time to ensure you're legally allowed to realize the vision for your home.

Zoning is how a community determines the use of a parcel of land. Common zoning types include commercial, residential, and agricultural. If you plan on having a home-based business or using part of your home as a vacation rental, you should check to see if the town's zoning laws permit these activities.

Knowing zoning laws is also important for remodeling. Communities may restrict the size and height of a house and how far away it must be from property lines or streets.

If the home is in a flood zone

Photo source: Canva

Extreme weather and rising ocean levels make it more important to know flooding risks. Publicly available flood maps may be decades outdated and therefore won't show the extent of high-risk flood areas. According to the Insurance Bureau of Canada, an estimated one million homes could be at risk of flooding over the next 20 years.

In the U.S., rising ocean levels are affecting places like South Florida, which could experience over 150 days per year, according to 2020 data from National Oceanic and Atmospheric Administration. Over the lifetime of a mortgage, this could add up to major expenses in terms of insurance and replacement costs.

Real estate agents can advise you about flood-prone areas.

If it's been on the market a long time

Photo source: Canva

A metric called "average days on market," or DOM, shows how long a property has been on the market. The counter starts on the day the property is listed for sale and ends on the day the sale contract for that property is signed. If it's been on the market for a long time, it could be a potential red flag.

If a home languishes on the market, it could indicate that the house is overpriced. It could also be a sign the property may have issues that lead buyers to pass it over.

Agents also check if a listing has been withdrawn and relisted a few days later. According to the article written by Balance Money published on September 2021, when that happens, the DOM goes back to zero, making it appear that the house hasn't been on the market very long, when the opposite is the case.

If appliances need to be replaced

Photo source: Canva

Appliances are not guaranteed to come with the home you buy. While leaving kitchen appliances is more common, a washer and dryer may not come with the sale. Real estate agents will find out what the seller intends to include with the property— so if that shiny new refrigerator is also moving out, that may affect your offer price.

Looking at the age of appliances is also important. If you're buying a house with a 20-year-old refrigerator, it may be near the end of its life span, so your purchasing budget may also have to accommodate new appliances soon. Older appliances also consume more energy—refrigerators alone can be 10% to 20% of a monthly electric bill—so they could cause your monthly bills to be higher than with new appliances that are more energy efficient, according to Stanford magazine, 2008.

Property taxes

Photo source: Canva

While it's often overlooked, property taxes are an important aspect of a home's price. Real estate agents will factor them into a budget to help understand whether the property is affordable for you.

Provincial/territorial or state, and local governments may levy property taxes on homeowners to pay for government services like education and infrastructure.

Property taxes can also be reassessed regularly to align with home valuations. Property taxes may also rise if home sales prices have soared in your desired neighborhood.

Speak to a TD advisor

Buying a home is an exciting journey. Speak to a TD advisor to find the right solution for you.

Share this article

Related articles

View personal banking updates and how we're ready to help you move forward.

Canada

Canada

US

US