You are now leaving our website and entering a third-party website over which we have no control.

Welcome to TD Business Central™

Thank you for joining us on our journey!

Welcome to TD Business CentralTM (TDBC), our new digital banking platform offering Business Banking customers secure, convenient, and connected banking solution. We are on a transformational journey to modernize our customers' digital banking experience, offering a breadth of currently available capabilities with more to come as we continue to evolve and introduce new services and features on TDBC.

We invite you to explore the new and exciting capabilities offered within TDBC and join us as we continue to deliver banking solutions designed to achieve your business goals.

TD Business CentralTM (TDBC) Benefits

TDBC has been created with your needs in mind. We invite you to explore the capabilities currently offered within this digital banking platform to experience how TDBC can help you achieve your business banking goals:

- Landing page that provides an overview of consolidated account balances, and quick access to platform features.

- Self-serve user registration and login credential recovery.

- Create and manage customized user permissions.

- View consolidated and aggregated account balances.

- Easy-to-navigate overview of your account activity for each service.

Access your online business banking securely with TD Authenticate™

TDBC and the TD AuthenticateTM app allow you to bank securely, using a digital token.

You will be asked to enter a one-time verification code confirming your identity at every login. These verification codes can be accessed via phone, or TD AuthenticateTM, which, will generate a code without the need for Wi-Fi or cellular reception. View the FAQ section below for more information.

TDBC Current Features

-

Account Activity Service

-

Account Transfer Service

-

Bill Payment Service

-

Interac e-Transfer® for Business

-

Wire Payment Tracker Service

-

Statements

-

Administration

-

Single Sign-On

Account Activity Service

Easily access balance and transaction information for your TD CDAs, Business Credit Cards and eligible Term and Operating Loans:

- Account balances are available at-a-glance for Business Deposit Accounts, Business Credit Cards, and many term and operating loan types.

- Transaction information is available for up to 18 months of historical data, regardless of the onboarding date, for Business Deposit Accounts, and term and operating loans. Transaction information is available for up to 6 months for Business Credit Cards.

- Enhanced reporting features to generate a Statement of Account or Consolidated Balance report, once or on a schedule for future dates.

- Place stop payments on cheques and pre-authorized payments drawn on authorized Canadian and U.S. dollar deposit accounts.

- Export information in CSV or pre-formatted PDF.

Account Transfer Service

Funds transfers between authorized TD Canadian and/or U.S. Dollar Business Deposit Accounts:

- Customizable credit/debit descriptions (up to 20 characters) and transfer templates (up to a maximum of 25) simplify transfer creation and reconciliation, encouraging consistency with repeat transfers.

- Optional limits and approval requirements tailored to suit your needs ensure that optimal functionality is provided while protecting you against theft and fraud.

- Third-party (external) transfer capabilities and "Credit Only" accounts, allow customers to move funds efficiently and securely.

- Enhanced foreign exchange experience offers integrated cross-currency TD bulletin rates (with live refresh every 20-seconds) and increased CAD-USD transfer thresholds (up to $1,000,000 USD).

- Ability to manage Mirror Accounting Service (MAS) operating accounts and Daylight limits.

- Transfer funds from customer's Canadian domiciled TDCT USD account to their U.S. domiciled American Business Banking account at TDBNA via the Southbound Express Transfer service.

Bill Payment Service

- Make bill payments to thousands of available payees.

- Added security and control by allowing you to choose one or two approvers to process Bill payments and payees.

- Process multiple bill payments in a single request, recurring or post-dated for up to 1 year.

- View pending and historical bill payments, with the ability to self-serve and cancel the same day, postdated, or recurring payments online.

Interac e-Transfer® for Business

TDBC offers Interac e-Transfer® for Business: a fast, easy, and secure payment option.

- Send up to $25,000 CAD per transaction, directly to eligible bank accounts within Canadian financial institutions, providing you with on- screen confirmation.

- Add optional information and remittance details, making reconciliation easier with less manual investigation.

Wire Payment Tracker Service

View your outgoing wire payment's journey:

- Wire payments initiated in Web Business Banking (WBB) are tracked in near real-time through the Swift GPI – network.

- Track your wire payment from initiation at TD to the date and time it is credited to the beneficiary.

- View foreign exchange and fees deducted by non-TD financial institutions.

Statements

View and download statements for Commercial Deposit Accounts (CDA)

- Offering convenient online access to CAD and USD deposit account bank statements.

- Existing customers with eStatements on WBB can access their historical statements on TDBC.

- Account Groups for searching statements can now include up to 5 accounts in a group.

Administration

TDBC offers enhanced control of your digital banking experience.

- Once the System Administrators (SAs) are assigned, they can create and manage additional users (including Administrators) within TDBC, assign and maintain customized permissions for users, with changes applied in real-time as well as monitor user activity with the Audit Log.

- Customers can assign up to 10 SAs for their company.

- Dual administration, once enabled, requires that any administrative change receives approval from a second SA or Administrator. This ensures enhanced security and minimizes the risk of unauthorized or mistaken changes. Customers can enable this feature either through TD or via TDBC.

Single Sign-On

When registered with Single Sign-On, you won't need to re-enter your login credentials each time you navigate between WBB and TDBC. You can select which of your multiple WBB Connect ID's to navigate to, enjoying seamless access between both banking platforms.

Coming Soon!

As TDBC continues to evolve, enhancements will be added. Check out the TDBC Roadmap for upcoming capabilities, including:

-

Incoming Wires Reporting Phase 1:

=> End of day wire report that supports new International Standard Organization (ISO) standards.

Frequently Asked Questions

Once you have successfully submitted your TDBC Enrolment Form to your Cash Management Team, your System Administrator will receive an email from us that will include a self-registration link.

After they have registered, your System Administrator can set up all required users in your company.

If you are the System Administrator named on the Enrolment Form, look for the email. You can always reach out to your MCM with any questions.

TD Business Central will progressively add new features, but for now there are still features you'll need to access through TD's Web Business Banking (WBB).

Single sign-on capabilities have been introduced for more streamlined access and we'll continue to enable new features as they become available. We're working towards offering all the features and benefits you expect from WBB, plus more on TDBC!

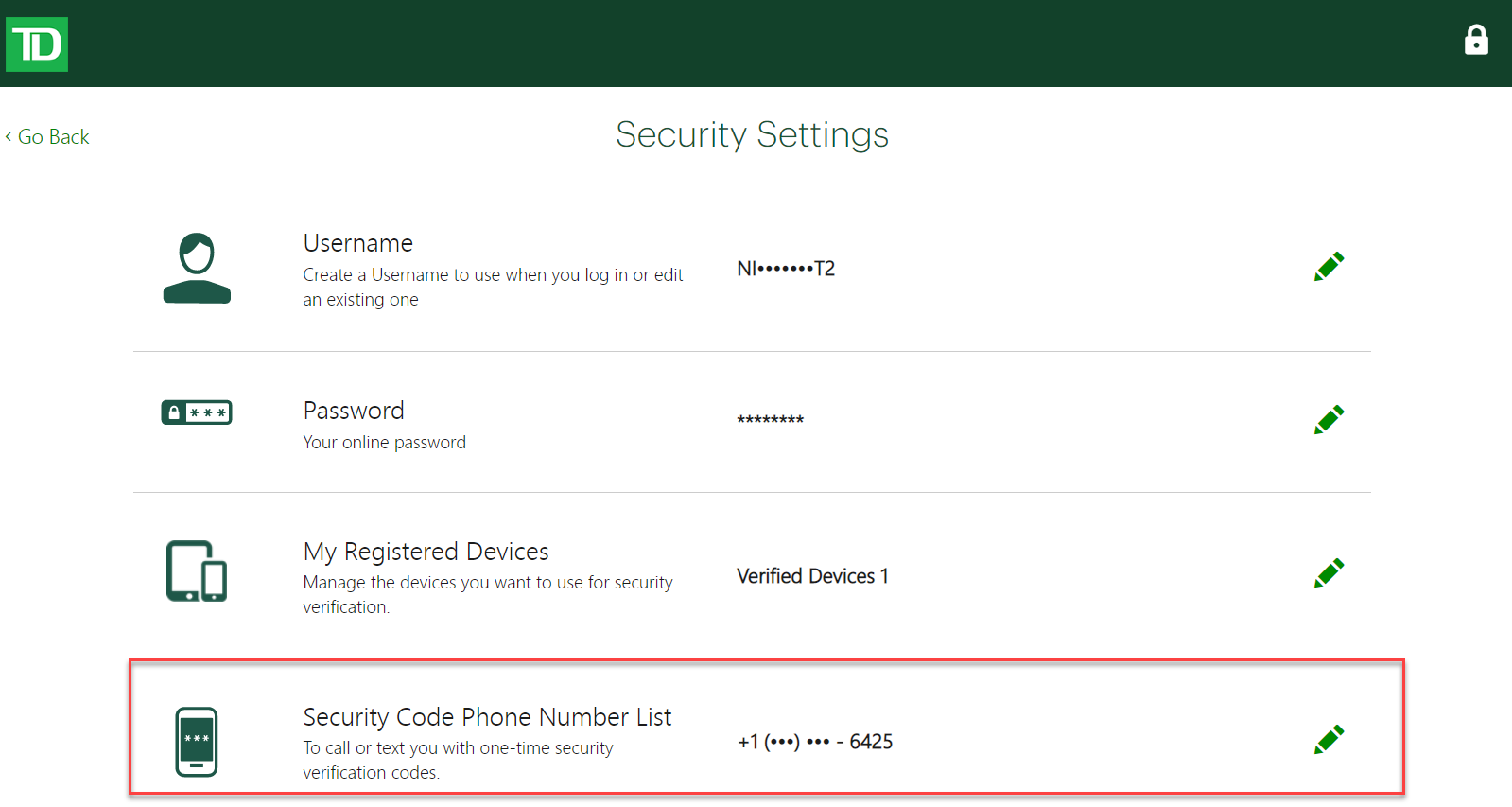

Effective Sept 27, you will be prompted to enter a verification code, along with your Username and Password, at every TDBC login. This Two-Step Verification process provides further protection against theft and fraud and supports the evolution of our TDBC capabilities. As you will be asked to input a unique code provided to you at a phone number connected to your Profile, we recommend adding additional phone numbers to your profile through your Security Settings or by installing TD Authenticate (see below).

Note: this enhanced verification cannot be overridden by the user-selected 'Security Code Login Option' in your Security Settings.

Ensure you can receive security verification codes from alternate numbers by updating your Preferences in TD Business Central. Users can include up to five contact numbers:

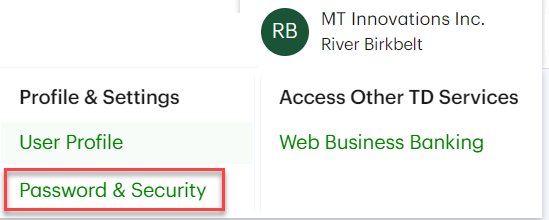

- Within TDBC, click on your name in the top right corner of your screen and select Password & Security under the Profile & Settings heading.

- Review your Security Code Phone Number List in your Security Settings. Click on the pencil icon to add additional numbers for use with TDBC.

Follow the steps below to install the app and register your TDBC credentials.

Install:

- Download the TD Authenticate app from the App Store or Google Play Store

- Open the app; "How it Works" will launch the Tutorial

Register:

- Open the TD Authenticate app, and click "Get Started"

- Login with your TDBC Credentials

- Generate a one-time security verification code via Call or Text

- Enable biometrics (optional)

- Create a 4-digit PIN

- Read and Accept the Terms & Conditions

When logging into TDBC:

- Select "Use TD Authenticate app"

- Open the TD Authenticate app on your registered device and select "Generate Verification Code"

- Enter your PIN (or use biometrics)

- Enter the displayed security verification code into your TDBC login

Canada

Canada

US

US