10-Year Milestone: The TD Greystone Infrastructure Fund

On August 31, 2024, TD Greystone Infrastructure Fund (the Fund) marked its 10-year anniversary with a since-inception, annualized return of 18.2% in CAD. This represents a significant milestone as the Fund has now joined just a few open-ended infrastructure strategies globally that have a 10-year track record.

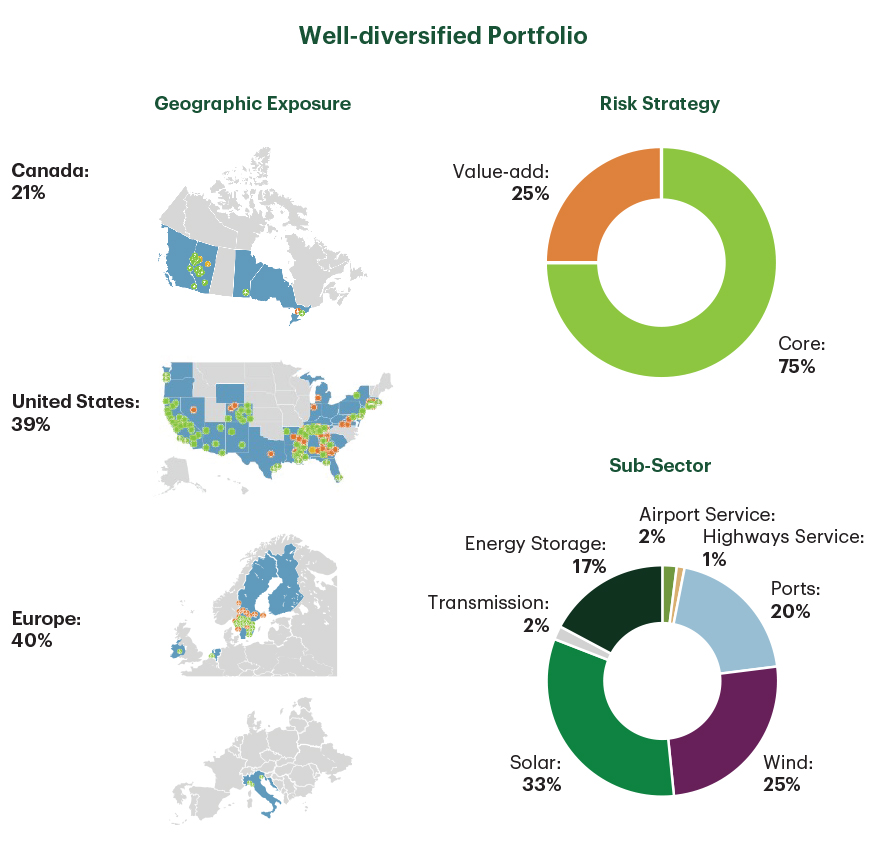

Over this 10-year period, the Fund experienced growth, and this summer, surpassed CAD $3.2 billion of Assets Under Management. The Fund now has 10 investment holdings with over 470 individual projects world-wide, with a significant value-add component that helps drive performance. The Fund offers an open-ended solution for clients to access global mid-market infrastructure, with core-plus and value-add attributes.

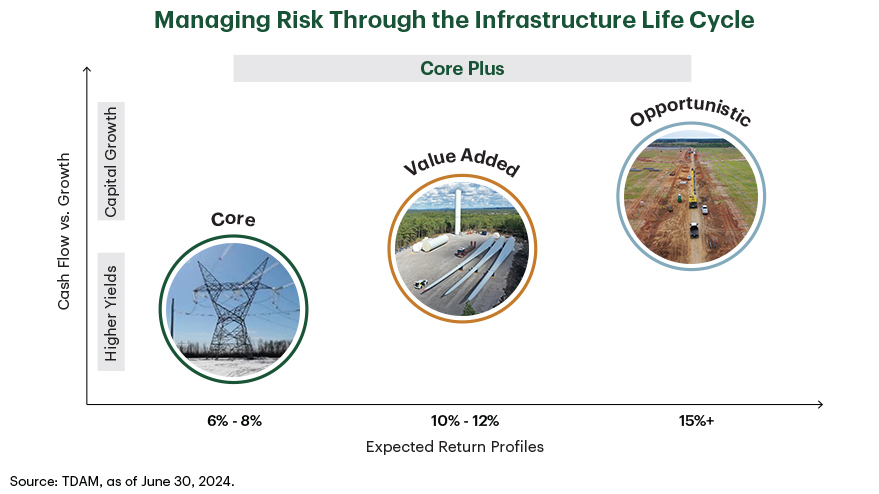

Strategic Approach to Value-Add

What sets the Fund apart is a consistent approach, developed over the past 10 years, to building new infrastructure. The team behind the Fund sees the lifecycle of infrastructure, from the early development stage to operating long-term projects, as a key source of returns. Over the years, we've built a portfolio where we've developed local teams focused on specialized sectors and geographies around the world, bringing our clients new development opportunities, local mergers and acquisitions, and a continued commitment to operational efficiency.

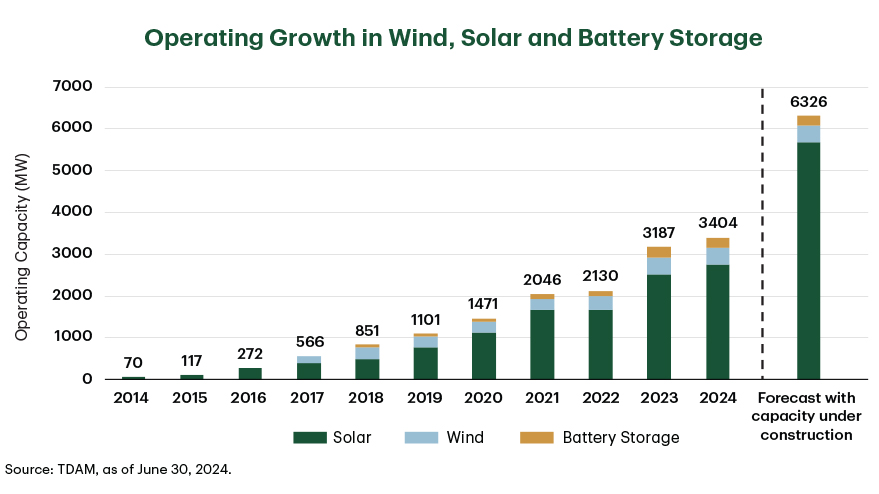

Executing in Energy Transition

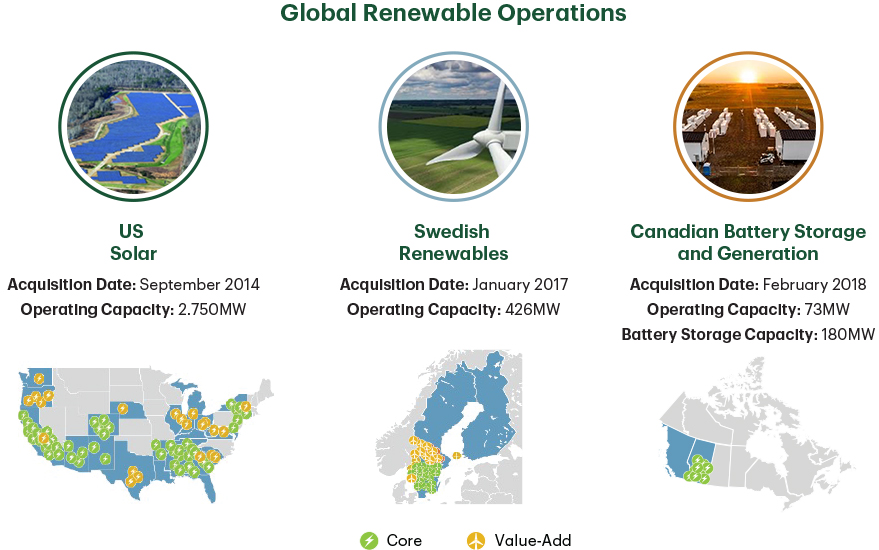

Today, the Fund boasts exposure to the operation of over 3,000 Megawatts of renewable energy, enough to power approximately 1 million homes, and our portfolio has enough development projects to nearly double that capacity in the next three to five years, providing our clients with growth visibility.

Our 10-year track record means that we've cultivated the ability to develop and grow assets over the long term for our clients. It also means that we've developed deep knowledge of the sectors we operate in, and we have the potential to innovate for the future. We've made progress in Canadian energy storage, and today we are Canada's largest operator of grid-connected storage,4 a sector we believe is poised for future growth.

The renewables portfolio spans North America and Europe across both wind and solar, with battery storage exposure at renewables sites and through our Canadian battery storage platform.

Source: TDAM.

A Nimble Approach to the Mid-market

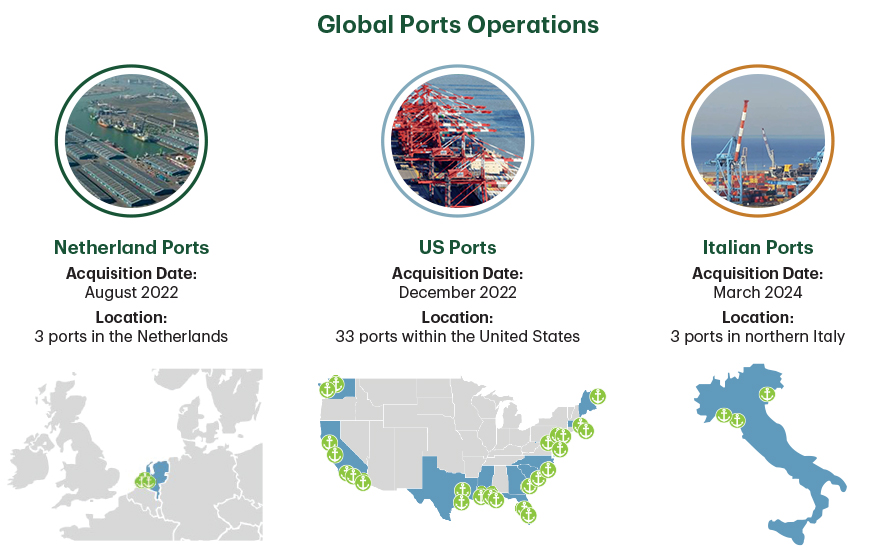

The long-term nature of our Fund means that we can take advantage of today's market dynamics to capitalize on trends that will benefit our clients for decades to come.

Over the past two years, we've acquired positions in global port operations across North America and Europe, creating a diversified portfolio of essential transportation assets for our clients.

At a time when many infrastructure investors have pulled back from transportation assets, coming out of the COVID-19 pandemic period, we saw an opportunity for entry points with operators that are well-known in the industry.

Over the next decade, we believe these ports are well positioned to improve supply chain reliability for their customers and grow their businesses as global trade trends continue to evolve.

Source: TDAM.

Beyond ports and renewable energy, the Fund's portfolio of 470+ assets also contains power generation assets in Western Canada, highway service plazas in the U.S., airport logistics facilities across Canada, and the largest transmission line in Canada5.

The portfolio has been built over the 10-year period with the goal of providing strong diversification of risk strategies, project-level economics and sector coverage.

Source: TDAM, as of June 30, 2024

The Next 10 Years

We have always had a multi-generational approach to investing in infrastructure, and today the Fund is ready for the next 10 years and beyond. We've strived to provide stability and investment excellence for the portfolio, with over 75% of our infrastructure investment team having been part of the Fund for more than half its life and the same founding Managing Director, Head of Global Infrastructure, Jeff Mouland.

This commitment to stability has allowed us to grow and develop a deep bench of talent to draw on for our portfolio. We also have a view to the future: next year, we expect growth in our London, England office, and global fundraising to expand our reach with clients has already begun.

1 TD Greystone Infrastructure Fund is comprised of TD Greystone Infrastructure Fund (Global Master) SCSp, TD Greystone Infrastructure Fund (Canada) L.P., TD Greystone Infrastructure Fund (Canada) L.P. II, TD Greystone Infrastructure Fund (Cayman Feeder) L.P. and TD Greystone Infrastructure Fund (Luxembourg Feeder) SCSp. Each of the feeder funds act as a feeder fund in a master-feeder structure and invests all or substantially all of its assets in TD Greystone Infrastructure Fund (Global Master) SCSp.

2 TD Greystone Infrastructure Fund (Global Master) SCSp produced a return of 11.41%, 10.11%, 11.36% and 15.74% in USD for the one-, three-, five- and 10-year periods since its inception, respectively, as of August 31, 2024.

TD Greystone Infrastructure Fund (Canada) L.P. produced a return of 11.05%, 12.55%, 11.70% and 18.21% in CAD for the one-, three-, five- and 10-year periods since its inception, respectively, as of August 31, 2024.

TD Greystone Infrastructure Fund (Canada) LP II produced a return of 11.45%, 10.19%, 11.35% and 10.11% in CAD for the one-, three-, five- and 10-year periods since its inception, respectively, as of August 31, 2024.

3 Includes the combined invested and committed capital of the TD Greystone Infrastructure Fund (Global Master) SCSp, the TD Greystone Infrastructure Fund (Canada) L.P., the TD Greystone Infrastructure Fund (Canada) L.P. II, the TD Greystone Infrastructure Fund (Cayman Feeder) L.P. and the TD Greystone Infrastructure Fund (Luxembourg Feeder) SCSp.

4 Source: https://calibercommunications.ca/enfinite-ereserve/

(Accessed on September 17, 2024.)

5 Source: https://www.electricity.ca/programs/centre-of-excellence/alberta-powerline-builds-canadas-longest-500-kv-ac-transmission-line/

(Accessed on September 17, 2024.)

For Canadian institutional investment professionals only. Not for further distribution.

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. These materials have not been reviewed by and are not registered with any securities or other regulatory authority in jurisdictions where we operate.

Any general discussion or opinions contained within these materials regarding securities or market conditions represent our view or the view of the source cited. Unless otherwise indicated, such view is as of the date noted and is subject to change. Information about the portfolio holdings, asset allocation or diversification is historical and is subject to change.

This document may contain forward-looking statements (“FLS”). FLS reflect current expectations and projections about future events and/or outcomes based on data currently available. Such expectations and projections may be incorrect in the future as events which were not anticipated or considered in their formulation may occur and lead to results that differ materially from those expressed or implied. FLS are not guarantees of future performance and reliance on FLS should be avoided.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Any characteristics, guidelines, constraints or other information provided for this material is representative of the investment strategy and is provided for illustrative purposes only. They may change at any time and may differ for a specific account. Each client account is individually managed; actual holdings will vary for each client and there is no guarantee that a particular client's account will have the same characteristics as described herein. Any information about the holdings, asset allocation, or sector diversification is historical and is not an indication of future performance or any future portfolio composition, which will vary. Portfolio holdings are representative of the strategy, are subject to change at any time and are not a recommendation to buy or sell a security. The securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that an investment in these securities or sectors was or will be profitable.

Past Performance: Any performance information referenced represents past performance and is not indicative of future returns. There is no guarantee that the investment objectives will be achieved.

The TD Greystone Infrastructure Fund is comprised of the TD Greystone Infrastructure Fund (Global Master) SCSp, the TD Greystone Infrastructure Fund (Canada) L.P., the TD Greystone Infrastructure Fund (Canada) L.P. II, the TD Greystone Infrastructure Fund (Cayman Feeder) L.P. and the TD Greystone Infrastructure Fund (Luxembourg Feeder) SCSp. Each of the Feeder Funds act as a feeder fund in a master-feeder structure and invests all or substantially all of its assets in the TD Greystone Infrastructure Fund (Global Master) SCSp.

Master:

The Master Fund is priced monthly in USD and includes any working capital within the Master Fund, as well as the current USD value of the most recent valuation of the underlying investments. Valuations of the investments held in the Master Fund are done semi-annually in the local currency of the investment. Interim valuations may be done as the result of specifical situations. At each monthly pricing period, the investment valuations are converted to USD at the rate in effect of the pricing date.

Effective February 1, 2024, the Master Fund redomiciled from the Cayman Islands to Luxembourg. Historical performance prior to that time reflects the performance of the TD Greystone Infrastructure Fund (Global Master) L.P. Thereafter, the performance reflects the TD Greystone Infrastructure Fund (Global Master) SCSp.

Feeders:

The Feeder Funds are priced monthly in U.S. dollars and reported to clients in Canadian dollars and include working capital held within the Feeder Funds as well as the updated monthly value of the units held in the Master Fund. The value of the Feeder Funds investment in the Master Fund is determined based on the updated monthly price of the Master Fund.

Performance for the Canadian Feeders:

Performance of the Canadian Feeder is reported to clients in Canadian dollars. Performance shown represents the performance of the TD Greystone Infrastructure Fund (Canada) LP Class B Shares from September 1, 2014 to December 31, 2014 and TD Greystone Infrastructure Fund (Canada) L.P. thereafter. The Class B shares consolidated with the Class A shares as of January 1, 2015.

TD Global Investment Solutions represents TD Asset Management Inc. ("TDAM") and Epoch Investment Partners, Inc. ("TD Epoch"). TDAM and TD Epoch are affiliates and wholly-owned subsidiaries of The Toronto-Dominion Bank.

® The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

Related content

More by this Author