The Role of Low Vol Strategies in Concentrated Markets

Since 2020, increasing levels of concentration in stock market indices have commanded widespread attention. The weight of 10 stocks now accounts for over a third of the S&P 500: an unprecedented level of concentration in the past two decades. This surge has largely benefited capitalization-weighted indices recently. Positive sentiment towards the Information Technology sector, partially fuelled by rapid advancements in Artificial Intelligence (AI), translated into soaring returns for a few mega-capitalization stocks dubbed the Magnificent 7. They include Meta, Alphabet, Nvidia, Tesla, Apple, Microsoft and Amazon.

Concentration Concerns

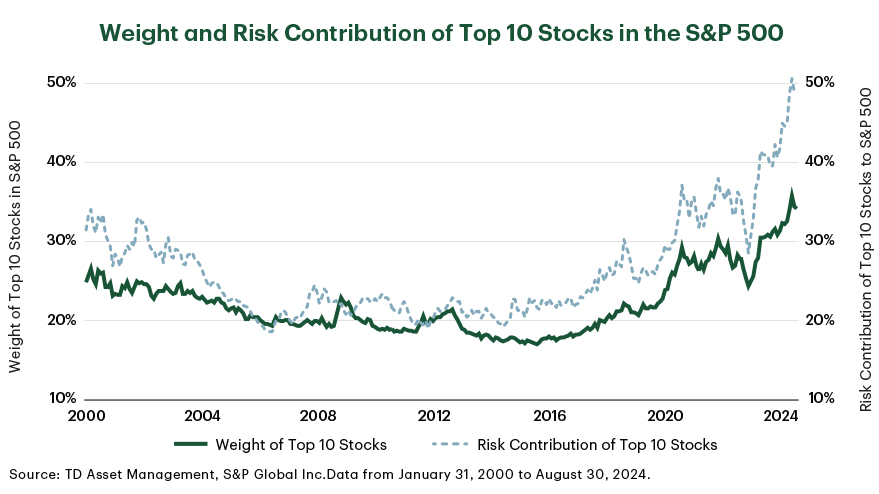

This swift development raises concerns about whether returns fuelled by climbing levels of concentration are sustainable. Historical data shows that market concentration, as measured by the weight of the top 10 stocks in an index, is prone to fluctuations. Periods of elevated concentration have been followed by the reversal of this trend, which means dilution is, at the very least, a possibility.

But is increasing concentration a sign of headwinds? That depends on several factors, including the risk associated with the most heavily weighted stocks. In the S&P 500, the top 10 stocks are massive companies residing in the Information Technology and Communication Services sectors, which tend to experience relatively larger price swings. Additionally, the lack of sector diversification amongst this group implies that there are overlapping factors driving the prices of stocks with the most power to influence index returns. The riskiness of this concentration is evidenced by the climbing levels of risk contribution attributed to the top 10. In an index of around 500 stocks, 10 make up approximately half of the volatility.

The Role of Low Vol Strategies in Offering Downside Protection

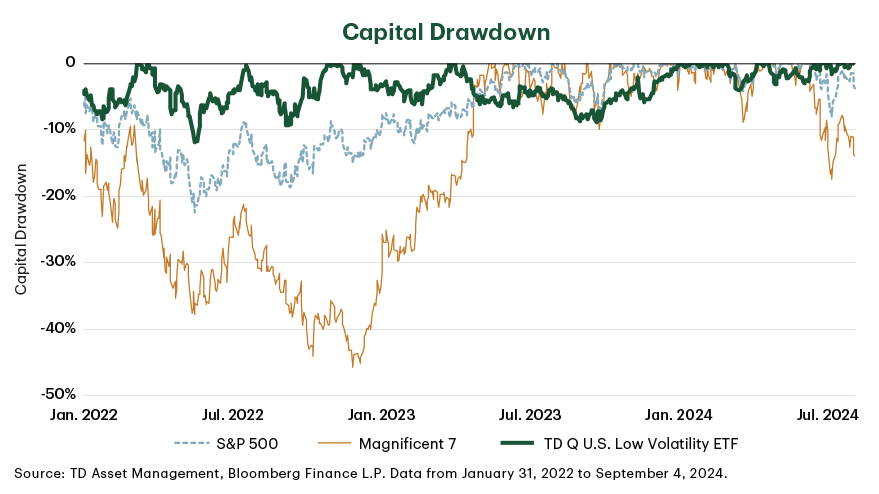

Investors seeking to insulate their portfolios from the riskiness of capitalization-weighted indices may look to low volatility strategies. TDAM's low volatility strategies are designed to be less concentrated than capitalization-weighted indices and they aim to avoid uncompensated risk. These strategies might be beneficial in down markets, as they typically offer enhanced downside protection relative to capitalization-weighted indices. This is important because market losses are asymmetric and compound exponentially; the larger the loss, the higher the gains needed to break even. By avoiding stocks with prices that have higher tendency to vary, low volatility equities focus on winning by not losing.

The selloffs in July, August, and early September this year exemplified how low volatility strategies can potentially shield investors from market whipsaws. Reminiscent of the downturn in 2022, concerns surrounding economic weakness and superfluous investment in AI by private companies mounted into a sizeable market reaction. Stocks with higher volatility, namely the Magnificent 7, bore the brunt of the dip in prices. On the other hand, the TD Q U.S. Low Volatility ETF provided portfolio protection by remaining steady and comparatively unaffected.1

Risk-aware investors aiming to weather market turmoil and reduce risk at the total asset mix level can potentially look to low volatility solutions for many of the same benefits as capitalization-weighted equities with lower risk and downside protection. These benefits may include comparable returns over the course of a full investment cycle, ease of implementation, and liquidity. Alternatively, investors with a risk budget can use low volatility strategies to redistribute their risk. This is achieved by reallocating the portion of their risk budget freed up by investing in low volatility equities to potentially more aggressive return-seeking assets. Looking forward, investors will likely continue to encounter unforeseen market events accompanied by bouts of volatility, underscoring the importance of preparation.

For more information, check out our earlier article De-Risking Portfolios with Low Volatility Equities.

1 As of August 31, 2024, the fund has posted a one-year return of 18.17% and a three-year return of 7.91%. It has delivered a return of 10.23% since its inception on May 26, 2020.

For Canadian institutional investment professionals only. Not for further distribution.

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, tax or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

This material is not an offer to any person in any jurisdiction where unlawful or unauthorized. These materials have not been reviewed by and are not registered with any securities or other regulatory authority in jurisdictions where we operate.

Any general discussion or opinions contained within these materials regarding securities or market conditions represent our view or the view of the source cited. Unless otherwise indicated, such view is as of the date noted and is subject to change. Information about the portfolio holdings, asset allocation or diversification is historical and is subject to change.

This document may contain forward-looking statements (“FLS”). FLS reflect current expectations and projections about future events and/or outcomes based on data currently available. Such expectations and projections may be incorrect in the future as events which were not anticipated or considered in their formulation may occur and lead to results that differ materially from those expressed or implied. FLS are not guarantees of future performance and reliance on FLS should be avoided.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds (ETFs). Please read the prospectus and ETF Facts before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commission will reduce returns. Index returns do not represent ETF returns. The indicated rates of return are the historical total returns for the periods including changes in unit value and reinvestment of all distributions and do not take into account redemption, commissions changes or income taxes payable by any unitholder that would have reduced returns. Past performance may not be repeated.

TD ETFs] are managed by TD Asset Management Inc., a wholly-owned subsidiary of The Toronto-Dominion Bank and are available through authorized dealers.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Any characteristics, guidelines, constraints or other information provided for this material is representative of the investment strategy and is provided for illustrative purposes only. They may change at any time and may differ for a specific account. Each client account is individually managed; actual holdings will vary for each client and there is no guarantee that a particular client's account will have the same characteristics as described herein. Any information about the holdings, asset allocation, or sector diversification is historical and is not an indication of future performance or any future portfolio composition, which will vary. Portfolio holdings are representative of the strategy, are subject to change at any time and are not a recommendation to buy or sell a security. The securities identified and described do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that an investment in these securities or sectors was or will be profitable.

The securities disclosed may or may not be a current investment in any strategy. Any reference to a specific company listed herein does not constitute a recommendation to buy, sell or hold securities of such company, nor does it constitute a recommendation to invest directly in any such company.

Bloomberg and Bloomberg.com are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. All rights reserved.

TD Global Investment Solutions represents TD Asset Management Inc. ("TDAM") and Epoch Investment Partners, Inc. ("TD Epoch"). TDAM and TD Epoch are affiliates and wholly-owned subsidiaries of The Toronto-Dominion Bank.

® The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

Related content

More by this Author