We have diversification, scale, and a unique footprint

$14.3 billion

2021 Reported Earnings

$14.6 billion

2021 Adjusted Earnings1

2,209

Retail locations in North America

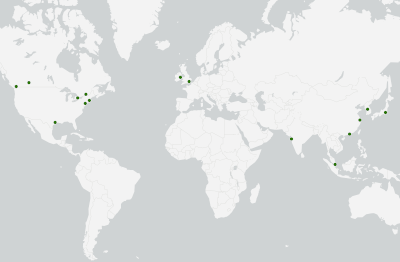

15

TD Securities offices worldwide

Safest Bank in North America

according to Global Finance3

TD’S PREMIUM RETAIL EARNINGS MIX2

dark green bar represents Reported U.S. Retail

gray green bar represents Reported Wholesale

90% Retail

10% Wholesale

We have a strong balance sheet

$1.7 trillion

Assets

15.2%

CET1 Ratio4

$1.1 trillion

Deposits

126%

Liquidity Coverage Ratio4

3.02%

Return on Risk-Weighted Assets5

(Financial information as at October 31, 2021)

We have a deep commitment to sustaining the trust of those we serve

Three core principles of our Risk Appetite

We take risks required to build our business, but only if those risks:

- Fit our business strategy and can be understood and managed

- Do not expose the enterprise to any significant single loss events; we don’t “bet the bank” on any single acquisition, business or product

- Do not risk harming the TD brand

1 Adjusted results are non-GAAP financial measures. Refer to “Non-GAAP and Other Financial Measures” in the “Financial Results Overview” section in the 2021 Management’s Discussion & Analysis (MD&A).

2 Reported basis excluding Corporate segment. Numbers may not add due to rounding.

3 Global Finance’s 30th annual ranking of the World’s Safest Banks published on September 15, 2021.

4 These measures have been calculated in accordance with OSFI’s Capital Adequacy Requirements and Liquidity Adequacy Requirements guidelines.

5 For additional information about this metric, refer to the Glossary in the 2021 MD&A.

2021 Snapshot

Performance indicators focus effort, communicate our priorities, and benchmark our results against key elements of our proven business model. Results in 2021 were affected by the COVID-19 pandemic.

| Performance Indicators6 | 2021 Results6, 8 (on an adjusted basis) |

|---|---|

|

|

NET INCOME

available to common shareholders

(millions of Canadian dollars)

TD’s 5-year CAGR

9.8% Reported

9.8% Adjusted8

DILUTED EARNINGS PER SHARE (EPS)

(Canadian dollars)

TD’s 5-year CAGR

10.6% Reported

10.2% Adjusted8

RETURN ON COMMON EQUITY9

(percent)

TD’s 2021 ROE

15.5% Reported

15.9% Adjusted8

DIVIDEND HISTORY

165-year

Continuous Dividend History

3.9%

2021 Dividend Yield9

12.4%

Total Shareholder Return9

(5-year CAGR11)

6 Performance indicators that include an earnings component are based on TD’s full-year adjusted results (except as noted).

7 Revenue is net of insurance claims and related expenses.

8 Adjusted results are non-GAAP financial measures. Refer to “Non-GAAP and Other Financial Measures” in the “Financial Results Overview” section in the 2021 MD&A.

9 For additional information about this metric, refer to the Glossary in the 2021 MD&A.

10 25-year CAGR is the compound annual growth rate calculated from 1996 to 2021.

11 5-year CAGR is the compound annual growth rate calculated from 2016 to 2021.