Proven business model

Deliver consistent earnings growth, underpinned by a strong risk culture

Our diversified, retail-focused business model and North American scale are powerful enablers - delivering strong results today, while allowing us to reinvest in our competitive advantages, as we build and transform our businesses to meet our needs today and in the future. Our approach to managing risk is evident in strong balance sheet metrics and reflects our commitment to sustaining the trust of those we serve.

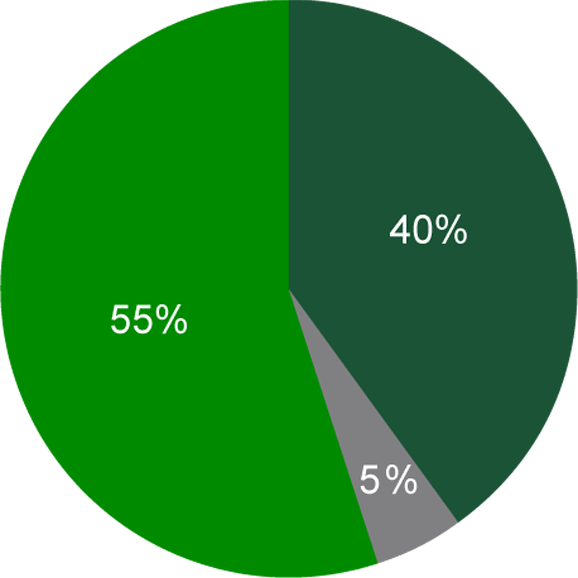

TD’S PREMIUM RETAIL EARNINGS MIX1

TD’s premium earnings mix reflects our North American retail focus – lower-risk businesses with stable, consistent earnings

Canadian Retail

Canadian Retail U.S. Retail

U.S. Retail Wholesale

Wholesale

- 95% Retail

- 5% Wholesale

Record Reported Earnings of $11.7 billion in 2019

$12.5 billion Adjusted earnings

Total Shareholder Return2

(5-year CAGR)

10.3%

7.7% Canadian peers

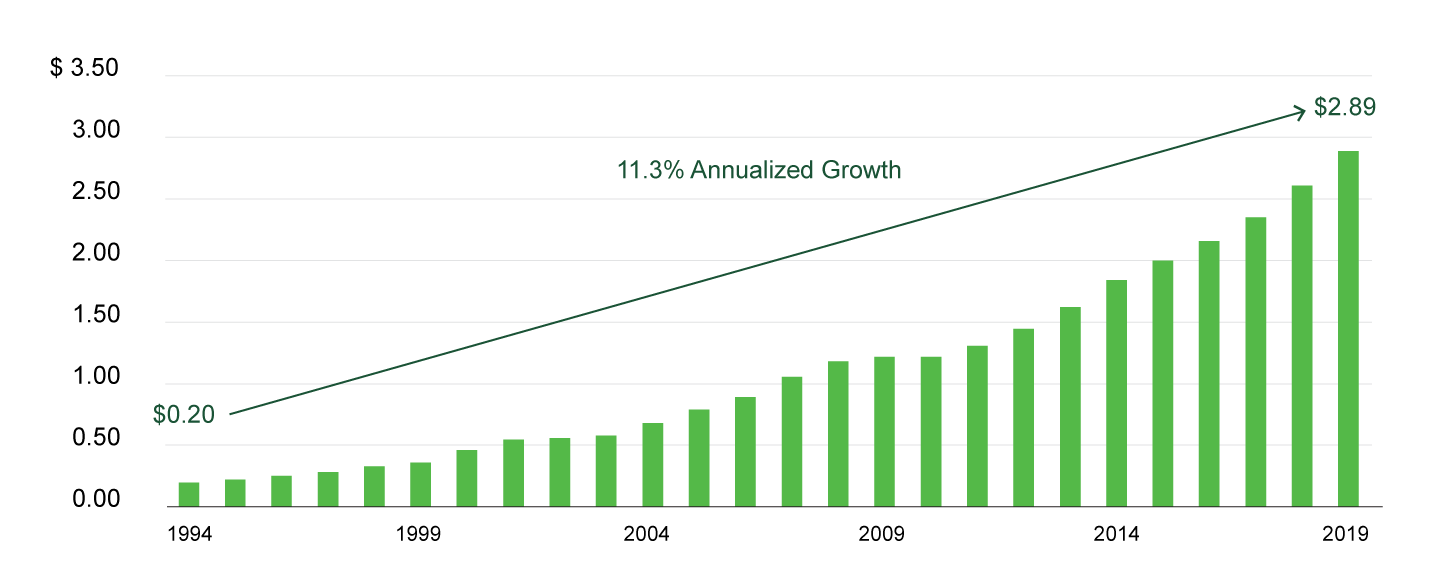

DIVIDEND HISTORY

163-year

Continuous Dividend History

11.3%

Dividend Growth3

(25-year CAGR)

3.9%

2019 Dividend Yield

2019 Snapshot

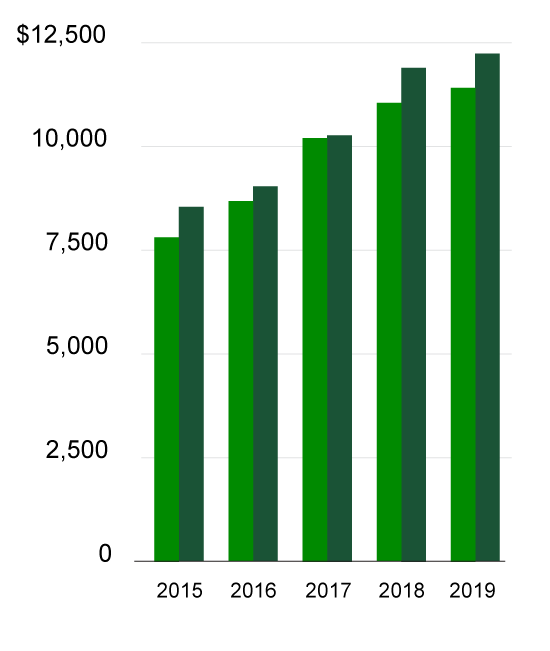

Net Income

available to common shareholders

(millions of Canadian dollars)

Reported

Reported

Adjusted

Adjusted

TD's 5-year CAGR

8.4% Reported

9.2% Adjusted

Diluted Earnings Per Share

(Canadian dollars)

Reported

Reported

Adjusted

Adjusted

TD's 5-year CAGR

8.6% Reported

9.4% Adjusted

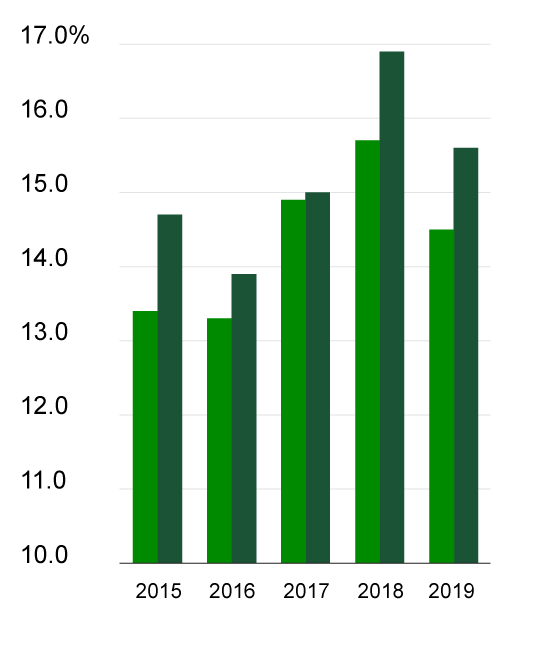

Return on Common Equity

(percent)

Reported

Reported

Adjusted

Adjusted

TD's 2019 ROE

14.5% Reported

15.6% Adjusted

Performance indicators communicate our priorities, focus effort and benchmark our results against key elements of our proven business model.

| 2019 performance indicators | Results4 |

|---|---|

|

|

Assets $1.4 trillion

Up 6.0% YoY

Deposits $0.9 trillion

Up 4.2% YoY

Return on Risk-Weighted Assets

2.73%

CET1 Ratio

12.1%

1 Reported basis excluding Corporate segment.

2 5-year CAGR is the compound annual growth rate calculated from 2014 to 2019. Source: Bloomberg. Canadian peers include Bank of Montreal, Canadian Imperial Bank of Commerce, Royal Bank of Canada, and Scotiabank.

3 25-year CAGR is the compound annual growth rate calculated from 1994 to 2019.

4 Performance indicators that include an earnings component are based on TD’s full-year adjusted results (except as noted) as explained on page 15.

5 Revenue is net of insurance claims and related expenses.

Refer to footnotes on page 15 of the complete annual report (available here) for information on how the results on this page are calculated.

back to top